Logs such as bank deposits and withdrawals and card payments have become "automatic journalizing", and "accounting input work" became quite easier compared to before.

However, in terms of "sales" in particular, it is too late to wait for the timing of "deposit". After all, it is desirable to record it as "sales as accounts receivable" at the time of "invoice" issuance... Rather, it's a must.

- 2016 - 11 - 22: Accounts receivable 120,000 / Sales 120,000 = Website creation (for company A)

- 2016 - 12 - 31: Saving deposit 120,000 / Accounts receivable 120,000 = Website creation (for company A)

Incidentally, on the contrary, there are cases where cannot include in "sales" at the time of issuing "Invoice" (even at the time of "deposit").

- 2016 - 12 - 31: Saving deposit 120,000 / Advance received 120,000 = Maintenance 2017 - 01 - 2017 - 12 (for Company A)

- 2017-01-01: Advance received 10,000 / sales 10,000 = 2017-01 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-02-01: Advance received 10,000 / sales 10,000 = 2017-02 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-03-01: Advance received 10,000 / sales 10,000 = 2017-03 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-04-01: Advance received 10,000 / sales 10,000 = 2017-04 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-05-01: Advance received 10,000 / sales 10,000 = 2017-05 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-06-01: Advance received 10,000 / sales 10,000 = 2017-06 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-07-01: Advance received 10,000 / sales 10,000 = 2017-07 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-08-01: Advance received 10,000 / sales 10,000 = 2017-08 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-09-01: Advance received 10,000 / sales 10,000 = 2017-09 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-10-01: Advance received 10,000 / sales 10,000 = 2017-10 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-11-01: Advance received 10,000 / sales 10,000 = 2017-11 of Maintenance 2017-01 to 2017-12 (for company A)

- 2017-12-01: Advance received 10,000 / sales 10,000 = 2017-12 of Maintenance 2017-01 to 2017-12 (for company A)

The creation method and creation timing of so-called "transfer slips" (transfer records) varies depending not only on the type of industry but also on company policy. Even so, the work itself should certainly be "automated".

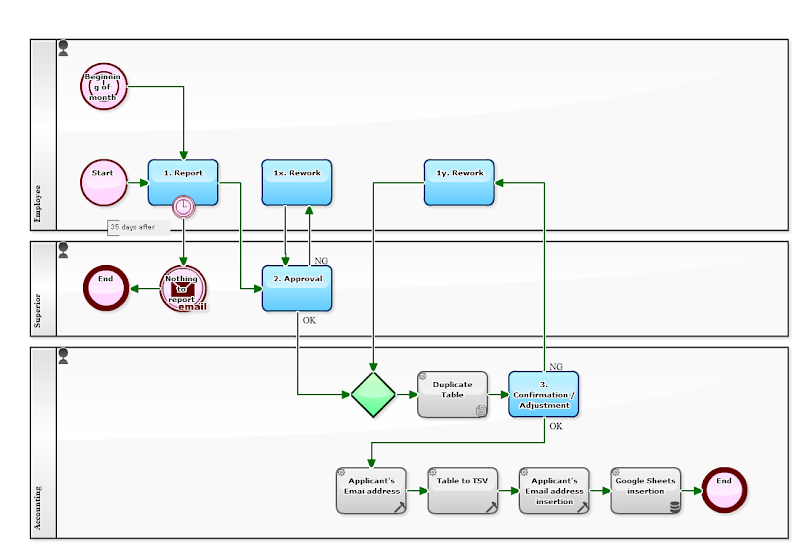

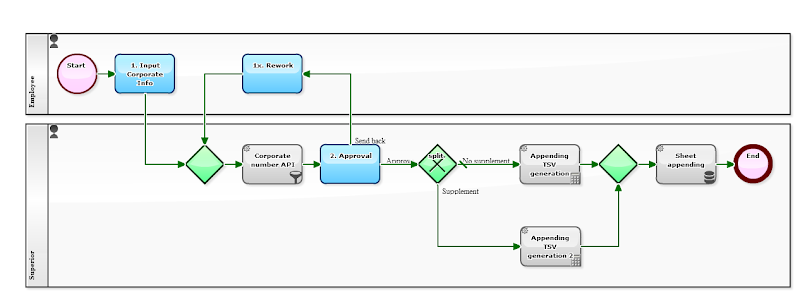

In the following Workflow, at the moment when the "Invoice" is approved by the supervisor,

- Receipt PDF will be emailed to he customer,

- Multiple line "transfer records" are automatically calculated

- The import file is automatically generated.

Accounting staff can finish "input work" by only uploading the automatically generated Excel-CSV file to the accounting system.

[Invoice Issuance flow]